DoorDash launched Accelerator for Local Goods programme to support businesses owned by minorities

DoorDash is in the news for launching a thoughtful cohort programme called Accelerator for Local Goods.

DoorDash is in the news for launching a thoughtful cohort programme called Accelerator for Local Goods.

This is the weekly snapshot of top grocery disruptions and trends in the Grocery industry (15 May-20 May.)

This summer, LA-based consumers would beat the heat by getting a mobile ice cream shop to deliver cold treats to their doorsteps.

In Q1, Walmart US is experiencing slowed sales growth, and its operating income gets a $1 billion hit.

Boxed, an American digital wholesale grocer, has partnered with FedEx, a renowned shipping and transportation company, to deliver more orders to consumers. The online wholesaler will reduce shipping costs across its fulfilment centres through this multi-layer association with FedEx. Moreover, this collaboration will help customers access the delivery service throughout the weekdays. Boxed intends to use the money saved from transportation costs to offer more discounts and promotions. This action will ease the ongoing supply chain disruptions and help the e-tailer deliver orders on time. Ryan Kelly, VP of e-commerce at FedEx, detailed that online retailers and shipping firms can effectively manage the logistic operations and costs to provide better delivery service. To read more, visit ProgressiveGrocer

This is the weekly snapshot of top trends from the Grocery industry (22 April-29 April.) AI & Robotics: McKinsey conducted a survey of European shoppers and revealed that most respondents plan to use online grocery services almost as frequently as they did in 2021. Store of the Future: A recent survey revealed that 2/3 of grocery businesses have quantified their baseline efforts and defined concrete actions to march towards sustainability efforts, and 50% have defined definite targets. Online Grocery: Grocery businesses often struggle to choose the right pricing strategy for their eCommerce business. Digital grocers choose from two main pricing strategies: offset pricing structure and up-front pricing structure. Consumer Trends: Heinen’s has launched a health clinic, the Personalized Nutrition Center, inside one of its retail outlets. The grocer is advancing digital technology and health to offer holistic services to consumers. Digital Supply Chain: Cate Trotter detailed that convenience and delivery speed are pushing delivery platforms to opt for ultra-fast delivery models in the US. She added that these hyper-fast delivery services would raise the customer expectations bar.

Salesforce, an American cloud-based software company, published its digital retail shopping trends in Q1 of 2022. The report exhibited a 3% year-over-year (YoY) drop in global online sales, and this is the first decline in the index’s nine-year history. Salesforce blamed rising inflation, supply chain woes, and economic instability for the decline in online sales. These obstacles have influenced and altered consumer purchasing power and behaviour. Additionally, the report shows a 12% decline in order volumes and a 2% drop in traffic. Online sales in Europe went down by 13% and order volume decreased by 17% due to people facing high fuel costs and the Ukraine-Russia war on their continent. To read more, visit Salesforce

Retail Gets Real interviewed Cate Trotter, the head of Insider Trends, to get the latest updates from the grocery delivery industry. Trotter detailed that convenience and delivery speed are pushing delivery platforms to opt for ultra-fast delivery models in the US. She added that these hyper-fast delivery services would raise the customer expectations’ bar. Businesses need to focus on which experiences to expedite and which functions need to be slowed down to keep going. Grocers need to make the best use of tech features like mobile phones, apps, geolocation, AR, and VR to enhance in-store experiences. To read more, visit NationalRetailFederation

This is the weekly snapshot of top trends from the Grocery industry in the past week (15 April-18 April.) AI & Robotics: Wakefern, the largest grocery retail cooperative in America, is in the process of piloting shelf-scanning robots from Simbe Robotics. The grocer is making this move to automate its inventory management process. Store of the Future: Land O’ Lakes, a dairy and food manufacturing platform, has been piloting a personalisation programme using a customer data platform (CDP) and the latest business analytics. Online Grocery: E-grocer Misfits Market has launched its first-ever private-label brand, Odds & Ends, to deliver pantry essentials to shoppers. Consumer Trends: Panera Bread has expanded and launched an $8.99/month subscription for unlimited coffee and tea to please coffee lovers. The subscription programme is called the Ultimate Sip Club and will offer around 26 self-service beverages Digital Supply Chain: Grocery Outlet has collaborated with Instacart to offer same-day delivery across nearly 400 stores to consumers.

When it comes to competition, Target and Amazon are neck-and-neck. Target’s revenue increased by 35% before the pandemic to over $105 billion. As per its 2021 full-year earnings report, Target fulfilled above 95% of all of its digital and physical orders from its stores. The brand transformed its stores into fulfilment centres, and that is its savvy business strategy. Target mostly focuses on physical retail and continuously expands its brick-and-mortar presence. Target has 400,000 employees working in one of the retailer’s 1,931 stores, dealing with customers daily, whereas Amazon’s workers are in its fulfilment centres or driving delivery vans. Amazon’s entire business lies in its online third-party marketplace, while Target sells through its web of stores. If we compare the rate of online sales growth over the past two years, Target is way ahead of Amazon. To read more, visit Inc

Amazon’s third-party marketplace has approximately 25% market share of the total US e-commerce spending. As per eMarketer data, in 2021, Amazon held up to 41.4% of all the e-commerce sales in the US. Amazon would have been the largest retailer if its third-party marketplace were independent. After Amazon Marketplace, Amazon retailer has 17% of the market share. Walmart’s market share is around 7-8%. eBay, Apple, and The Home Depot have been losing market share in the past years due to cut-throat competition from Amazon and Walmart. Although Shopify is not on the list, it would have been the third biggest retailer if all the Shopify vendors were one retailer. To read more, visit Marketplacepulse

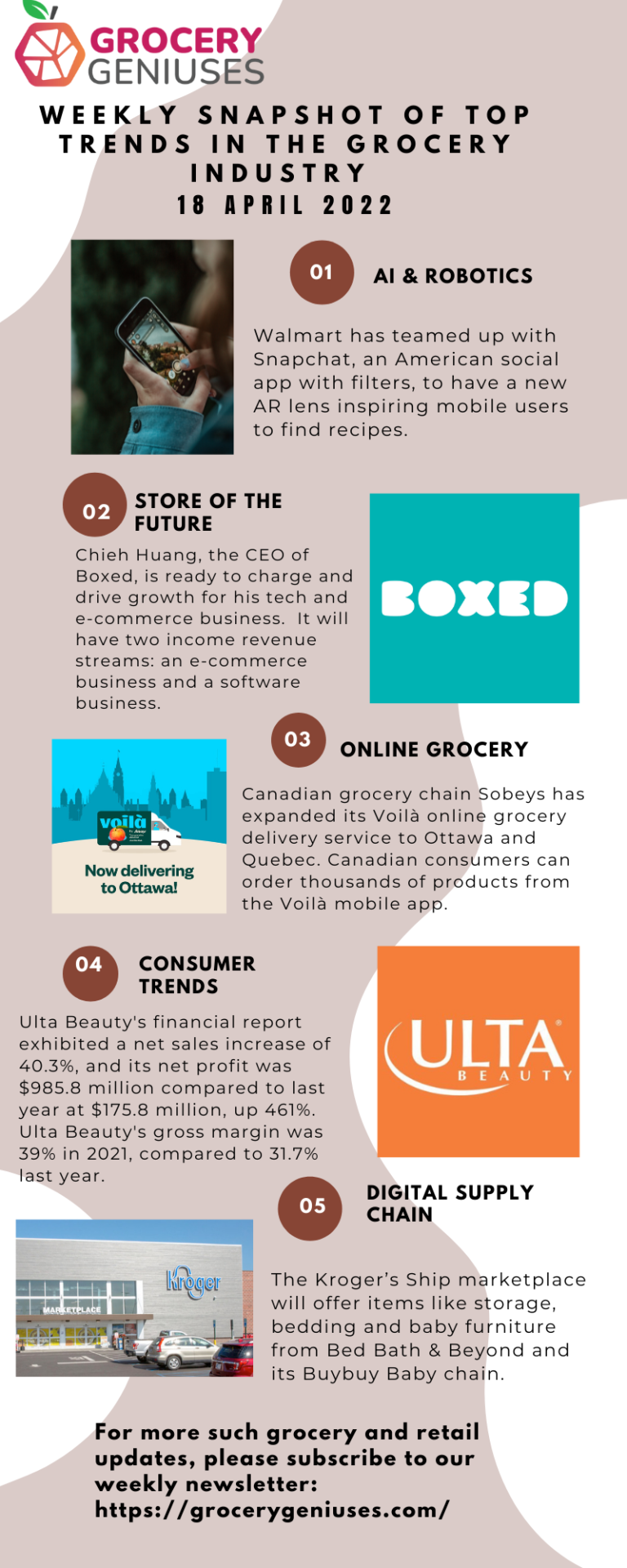

This is the weekly snapshot of top trends from the Grocery industry in the past week (08 April-15 April.) AI & Robotics: Walmart has teamed up with Snapchat, an American social app with filters, to have a new AR lens inspiring mobile users to find recipes. Store of the Future: Chieh Huang, the CEO of Boxed, an e-tailer offering bulk products, is ready to charge and drive growth for his tech and e-commerce business. It will have two income revenue streams: an e-commerce business and a software business. Online Grocery: Canadian grocery chain Sobeys has expanded its Voilà online grocery delivery service to Ottawa and Quebec. Canadian consumers can order thousands of products, including the Sobeys Farm Boy store banner, from the Voilà mobile app. Consumer Trends:Ulta Beauty’s financial report exhibited a net sales increase of 40.3%, and its net profit was $985.8 million compared to last year at $175.8 million, up 461%. Ulta Beauty’s gross margin was 39% in 2021, compared to 31.7% last year. Digital Supply Chain: The Kroger’s Ship marketplace will offer items like storage, bedding and baby furniture from Bed Bath & Beyond and its Buybuy Baby chain.

DoorDash is in the news for launching a thoughtful cohort programme called Accelerator for Local Goods.

This is the weekly snapshot of top grocery disruptions and trends in the Grocery industry (15 May-20 May.)

This summer, LA-based consumers would beat the heat by getting a mobile ice cream shop to deliver cold treats to their doorsteps.

In Q1, Walmart US is experiencing slowed sales growth, and its operating income gets a $1 billion hit.

Boxed, an American digital wholesale grocer, has partnered with FedEx, a renowned shipping and transportation company, to deliver more orders to consumers. The online wholesaler will reduce shipping costs across its fulfilment centres through this multi-layer association with FedEx. Moreover, this collaboration will help customers access the delivery service throughout the weekdays. Boxed intends to use the money saved from transportation costs to offer more discounts and promotions. This action will ease the ongoing supply chain disruptions and help the e-tailer deliver orders on time. Ryan Kelly, VP of e-commerce at FedEx, detailed that online retailers and shipping firms can effectively manage the logistic operations and costs to provide better delivery service. To read more, visit ProgressiveGrocer

This is the weekly snapshot of top trends from the Grocery industry (22 April-29 April.) AI & Robotics: McKinsey conducted a survey of European shoppers and revealed that most respondents plan to use online grocery services almost as frequently as they did in 2021. Store of the Future: A recent survey revealed that 2/3 of grocery businesses have quantified their baseline efforts and defined concrete actions to march towards sustainability efforts, and 50% have defined definite targets. Online Grocery: Grocery businesses often struggle to choose the right pricing strategy for their eCommerce business. Digital grocers choose from two main pricing strategies: offset pricing structure and up-front pricing structure. Consumer Trends: Heinen’s has launched a health clinic, the Personalized Nutrition Center, inside one of its retail outlets. The grocer is advancing digital technology and health to offer holistic services to consumers. Digital Supply Chain: Cate Trotter detailed that convenience and delivery speed are pushing delivery platforms to opt for ultra-fast delivery models in the US. She added that these hyper-fast delivery services would raise the customer expectations bar.

Salesforce, an American cloud-based software company, published its digital retail shopping trends in Q1 of 2022. The report exhibited a 3% year-over-year (YoY) drop in global online sales, and this is the first decline in the index’s nine-year history. Salesforce blamed rising inflation, supply chain woes, and economic instability for the decline in online sales. These obstacles have influenced and altered consumer purchasing power and behaviour. Additionally, the report shows a 12% decline in order volumes and a 2% drop in traffic. Online sales in Europe went down by 13% and order volume decreased by 17% due to people facing high fuel costs and the Ukraine-Russia war on their continent. To read more, visit Salesforce

Retail Gets Real interviewed Cate Trotter, the head of Insider Trends, to get the latest updates from the grocery delivery industry. Trotter detailed that convenience and delivery speed are pushing delivery platforms to opt for ultra-fast delivery models in the US. She added that these hyper-fast delivery services would raise the customer expectations’ bar. Businesses need to focus on which experiences to expedite and which functions need to be slowed down to keep going. Grocers need to make the best use of tech features like mobile phones, apps, geolocation, AR, and VR to enhance in-store experiences. To read more, visit NationalRetailFederation

This is the weekly snapshot of top trends from the Grocery industry in the past week (15 April-18 April.) AI & Robotics: Wakefern, the largest grocery retail cooperative in America, is in the process of piloting shelf-scanning robots from Simbe Robotics. The grocer is making this move to automate its inventory management process. Store of the Future: Land O’ Lakes, a dairy and food manufacturing platform, has been piloting a personalisation programme using a customer data platform (CDP) and the latest business analytics. Online Grocery: E-grocer Misfits Market has launched its first-ever private-label brand, Odds & Ends, to deliver pantry essentials to shoppers. Consumer Trends: Panera Bread has expanded and launched an $8.99/month subscription for unlimited coffee and tea to please coffee lovers. The subscription programme is called the Ultimate Sip Club and will offer around 26 self-service beverages Digital Supply Chain: Grocery Outlet has collaborated with Instacart to offer same-day delivery across nearly 400 stores to consumers.

When it comes to competition, Target and Amazon are neck-and-neck. Target’s revenue increased by 35% before the pandemic to over $105 billion. As per its 2021 full-year earnings report, Target fulfilled above 95% of all of its digital and physical orders from its stores. The brand transformed its stores into fulfilment centres, and that is its savvy business strategy. Target mostly focuses on physical retail and continuously expands its brick-and-mortar presence. Target has 400,000 employees working in one of the retailer’s 1,931 stores, dealing with customers daily, whereas Amazon’s workers are in its fulfilment centres or driving delivery vans. Amazon’s entire business lies in its online third-party marketplace, while Target sells through its web of stores. If we compare the rate of online sales growth over the past two years, Target is way ahead of Amazon. To read more, visit Inc

Amazon’s third-party marketplace has approximately 25% market share of the total US e-commerce spending. As per eMarketer data, in 2021, Amazon held up to 41.4% of all the e-commerce sales in the US. Amazon would have been the largest retailer if its third-party marketplace were independent. After Amazon Marketplace, Amazon retailer has 17% of the market share. Walmart’s market share is around 7-8%. eBay, Apple, and The Home Depot have been losing market share in the past years due to cut-throat competition from Amazon and Walmart. Although Shopify is not on the list, it would have been the third biggest retailer if all the Shopify vendors were one retailer. To read more, visit Marketplacepulse

This is the weekly snapshot of top trends from the Grocery industry in the past week (08 April-15 April.) AI & Robotics: Walmart has teamed up with Snapchat, an American social app with filters, to have a new AR lens inspiring mobile users to find recipes. Store of the Future: Chieh Huang, the CEO of Boxed, an e-tailer offering bulk products, is ready to charge and drive growth for his tech and e-commerce business. It will have two income revenue streams: an e-commerce business and a software business. Online Grocery: Canadian grocery chain Sobeys has expanded its Voilà online grocery delivery service to Ottawa and Quebec. Canadian consumers can order thousands of products, including the Sobeys Farm Boy store banner, from the Voilà mobile app. Consumer Trends:Ulta Beauty’s financial report exhibited a net sales increase of 40.3%, and its net profit was $985.8 million compared to last year at $175.8 million, up 461%. Ulta Beauty’s gross margin was 39% in 2021, compared to 31.7% last year. Digital Supply Chain: The Kroger’s Ship marketplace will offer items like storage, bedding and baby furniture from Bed Bath & Beyond and its Buybuy Baby chain.

The global food and grocery retail industry is expected to surpass $17T by 2027, expanding at an annual rate of 5%. During this time, digitisation is set to transform the entire food value chain from farm to fork. Our weekly newsletter covers innovations and disruptions in food and grocery industry.

GroceryGeniuses is managed by IndustryGeniuses (A place where industries meet innovation). We are rolling out content platforms for the world’s hottest industries such as Food & Grocery Retail, Consumer Goods and Healthcare. For each of these key industries, we support industry leaders as they roll out next generation digital initiatives.

IndustryGeniuses team brings practical domain knowledge of working with 300+ tech startups and brands over the past decade.